In the world of DePIN (Decentralized physical infrastructure networks), a project is only as good as its economic foundations. At NATIX, we’ve designed our tokenomics to be truly deflationary, setting us up for success as a DePIN and ensuring a vibrant ecosystem while maintaining a sustainable token economy.

The NATIX tokenomics model is crafted to ensure value and sustainability for $NATIX token holders. Through our design, the value of the $NATIX token is designed to increase over time as the supply decreases. We use every opportunity to accrue value to the token, with the main mechanism being token burning, via buyback or directly from fees, along with keeping a maximum fixed supply, which ensures our economic model is fully deflationary.

The NATIX deflationary model transforms the $NATIX token into a lucrative investment asset, incentivizing hodling and ensuring value and sustainability for $NATIX token holders. We constantly accrue value to the token by burning, via buyback, or directly from fees, while keeping a fixed maximum supply, to maintain long-term value preservation.

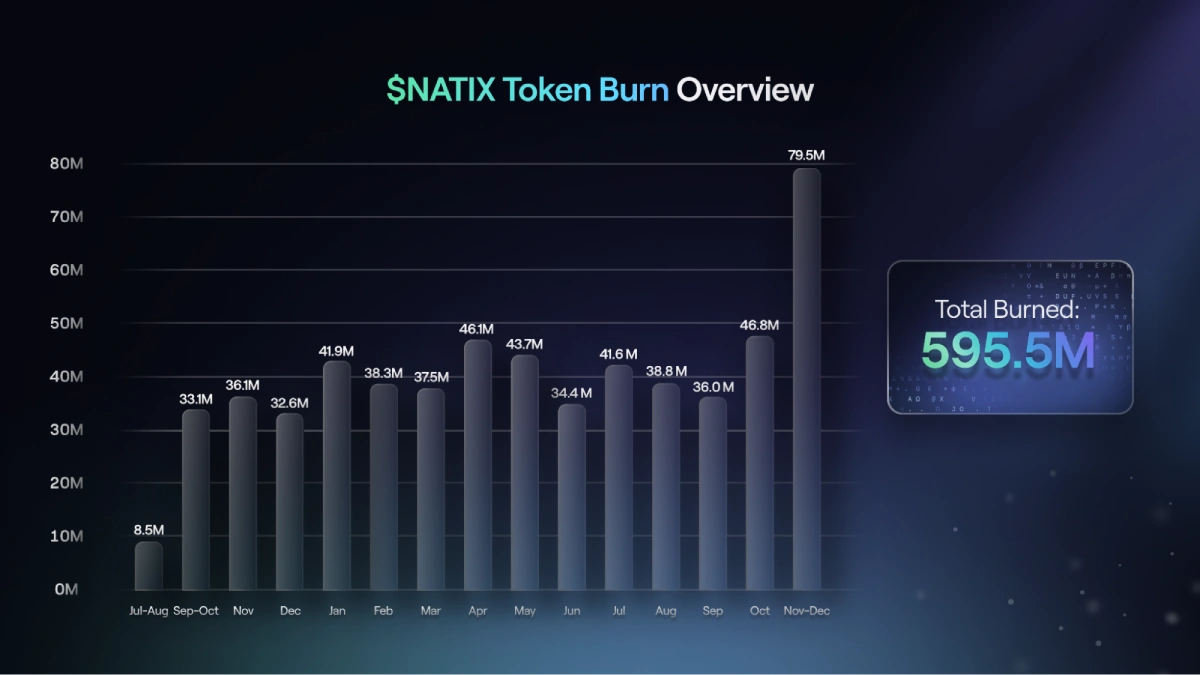

We’ve already burned 595,563,888.6934 $NATIX tokens – collected from (instant withdrawal) fees and our protocol revenue (Marketplace & data monetization) since the token launch (July 10th, 2024 – December 31st, 2025).

By consistently burning tokens, we can establish a sustainable and valuable ecosystem for all $NATIX holders. Below is a summary of how fees and protocol revenue contribute to token burning and value accrual.

NATIX has implemented a series of strategic fees designed to enhance the long-term sustainability of the $NATIX economy. These fees include instant conversions from in-app NATIX to $NATIX, and instant unstaking fees. The fees primarily aim to create a robust token economy that rewards thoughtful participation and discourages hasty or speculative behavior.

By collecting these fees and burning the corresponding tokens, NATIX effectively reduces the overall supply of $NATIX, which helps stabilize the value of the token over time. This mechanism safeguards against inflation, market volatility, and impulsive behavior, ensuring that the token maintains its value and utility within the ecosystem.

By imposing a cost on instant transactions, NATIX encourages users to engage more thoughtfully with the platform, aligning their actions with the long-term vision of the project. The burning process also reinforces the scarcity of $NATIX, making it a more attractive asset for long-term holders and users who are genuinely invested in the project's success.

Moreover, these fees capture any speculative or impulsive actions that could potentially disrupt the economy. This approach not only promotes responsible behavior but also ensures that the $NATIX token economy remains sustainable and resilient in the face of market fluctuations.

The current burn includes the Drive& instant withdrawal fees, instant unstaking fees, and protocol revenue, including Marketplace sales and data monetization buyback between July 10, 2024, and December 31, 2025.

The Revenue generated from our protocol is used for:

Protocol revenue streams include:

We are committed to full transparency regarding the burning processes for the $NATIX token. Now that the $NATIX token is up and running, and most burning functionalities are operational, we’ve already burned 595,563,888.6934 tokens – The proof of burning can be found here and here:

Starting in 2026, the burning process will occur quarterly, where we report how many $NATIX tokens have been burned, and provide proof for it. Keep an eye out for the reports to see the ongoing impact of our deflationary tokenomics model.

Join us on this journey towards creating a more valuable and sustainable DePIN ecosystem. Make sure you follow our Twitter @NATIXNetwork to stay up-to-date with our progress.